5 Life-Changing Lessons from Rich Dad Poor Dad

Rich Dad Poor Dad Lessons

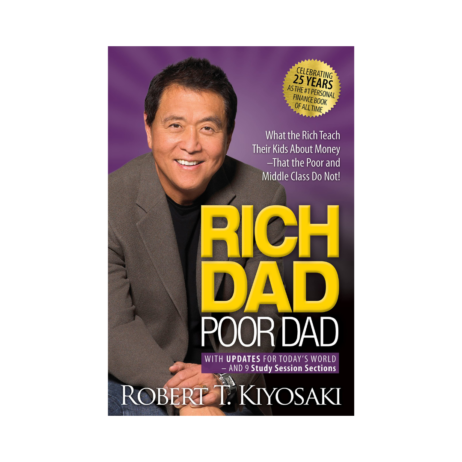

Robert Kiyosaki’s Rich Dad Poor Dad is more than just a book about money—It’s a personal finance book by Robert Kiyosaki that contrasts the financial philosophies of his two “dads”—his biological father and the father of his best friend. It challenges traditional beliefs about wealth and financial success, teaching us lessons that schools often fail to. If you’re looking to break free from the paycheck-to-paycheck cycle and build long-term wealth, here are five life-changing lessons from Rich Dad Poor Dad.

1. The Rich Don‘t Work for Money – They Make Money Work for Them

One of the greatest mindset changes in Rich Dad Poor Dad is realizing that the rich don‘t work to make money—they get their money to work for them. Most people work off a salary, but the rich invest in assets that make passive income.

Lesson: Rather than working tirelessly for a salary, begin creating income-producing assets such as stocks, real estate, or businesses. Your objective should be financial independence, not merely job security.

2. Know the Difference Between Assets and Liabilities

Kiyosaki makes financial education easy by defining two terms:

Assets put money in your pocket. (Investments, rental properties, stocks)

Liabilities take money out of your pocket. (Car loans, credit card debt, high-tech gadgets)

Most people believe their residence is an asset, but unless it‘s making money, it‘s a liability.

Lesson: Prioritize the accumulation of assets that build up wealth over time and avoid unnecessary liabilities that suck away your income.

3. Financial Education Is More Valuable Than a Big Paycheck

One of the most common misconceptions is thinking that a high income ensures wealth. But with no financial knowledge, even someone who makes a lot of money can be poor. Kiyosaki teaches that to be wealthy, you need to learn about taxes, investing, and cash flow.

Lesson: Invest in your own education—read books, take classes, and study investing. Wealth is not how much you make but how smart you are at keeping and growing your money.

4. Work to Learn, Not Merely to Earn

Many people take jobs for money, but Kiyosaki advocates working in jobs that are educational. Studying sales, marketing, communication, and investing can lead to the freedom of financial independence.

Lesson: Be on the lookout for opportunities to increase your finances, business, and investing know-how instead of merely seeking a paycheck. Good skills will end up making you wealthy in the long term.

5. The Power of Passive Income and Entrepreneurship

The rich don‘t simply have a job; they have several sources of income. Kiyosaki highly recommends entrepreneurship, real estate, and other investments that bring passive income. This enables you to become financially free without being stuck in a 9-to-5 job.

Lesson: Seek out opportunities to make money in your sleep—whether through part-time ventures, rental income, or investments. Your aim should be to establish a mechanism where money comes in even when you are not directly laboring.

Final Thoughts

Rich Dad Poor Dad is not only a book—it‘s a wake-up call for your finances. With a change of mind and implementing these principles, you can head towards financial freedom and a brighter future. Be it investing in assets, educating yourself with the money, or building passive income channels, each decision you make today will define your future finances.

Order your copy of Rich Dad Poor Dad today! Click here to purchase

Which of these lessons rings the loudest for you? Tell us in the comments!

📲 Follow us on Instagram for more financial tips and book recommendations: @akshar_books